Apps That Can Help Raise Your Credit Score

By Melisha Daniels - Updated: November 30, 2022Let's talk about it. Good credit is important. People with high credit scores have access to benefits that come with good credit such as lower interest rates, priority discounts and other financing options when they make large purchases like homes, cars and businesses.

A low credit score can affect your ability to find suitable housing, finance a car and in some instances your ability to gain a management position. A high credit score is not only a sign of financial health, it can also be the key to building generational wealth.

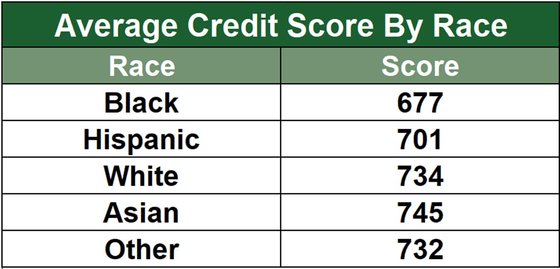

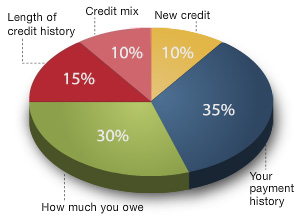

A 2019 study by Experian showed that on average credit scores for people of color fall 30 to 60 points behind other races. With payment history making up 35% of what credit bureaus take into consideration, being able to prove you can make payments on time becomes increasingly important. For Blacks and Hispanics, who have higher unemployment rates than other races, access to career-related employment and stable income serve as barriers to getting financing and establishing a positive payment history.

(Badcredit.org\Data Compiled by Experian -2019)

(Badcredit.org\Data Compiled by Experian -2019)

Traditionally payment history is established by making payments for bank issued credit cards, mortgages and car loans. For those of us living near or below poverty levels the only monthly payments being made are the rent, utilities and that Netflix and Chill bill.

(https://www.ficoscore.com)

To help solve these barriers JustasIam.Careers has put together this list of Apps that can help raise your credit score.

Altro App

Created by a a group of investors, the Altro.io App can be downloaded from the website at www.altro.io or the Apple Play Store. Per the company's website, Altro helps you build credit and financial power through the recurring payments and subscriptions you use every day. The app is not only a financial literacy tool with investment, personal finance and money management tutorials. It also includes a Subscriptions card that reports 3 of your favorite monthly subscriptions payments to the credit reporting bureaus.

Experian Boost

The Experian Boost App is made by Experian, one of the 3 main credit reporting bureaus. The App connects to your bank statement and raises your credit score by taking into account monthly payments you make to your car insurance, utilities, Hulu and Netflix.

Self-Build

The Self Credit Builder Loans formerly SelfLender allows you to save money while building credit. The app allows you to get a loan in the form of a CD that is secured by making monthly payments of at least $25. Once you've made all of the payments according to the agreement the money becomes available to you minus charges for interest and other fees. Self also offers a credit card, that can be funded with your loan.

Chime - Credit Builder

The Chime - Credit Builder Card is a self-funded secured credit card. Made by the Chime online banking account company, once approved you will be issued a Visa credit card that charges no annual fees or interest. There is no credit check to apply and no minimum deposit requirements. The Chime - Credit Builder Card reports to all 3 major credit bureaus and can increase your credit score up to 30 points.

Each app has it's own requirements and terms. If you make the payments on time, they offer a way to increase your credit score.